There are no guarantees that working with an adviser will yield positive returns. This type of transfer incurs a 1.75 fee (a minimum fee of 0.25 and a maximum fee of 25 is deducted from the transfer amount for each transfer) and typically arrives within 30 minutes. First, you’ll need to enroll in Send & Split, which can be found in the Account tab of the Amex App. There are two ways to get your money out of your Venmo account: Instant transfer to your eligible bank account or debit card. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). Yes Eligible Card Members can use the American Express App to send money to any Venmo or PayPal user. This fee is the same for all business profiles, regardless of business size or.

#DOES VENMO CHARGE A FEE TO TRANSFER MONEY TO BANK PLUS#

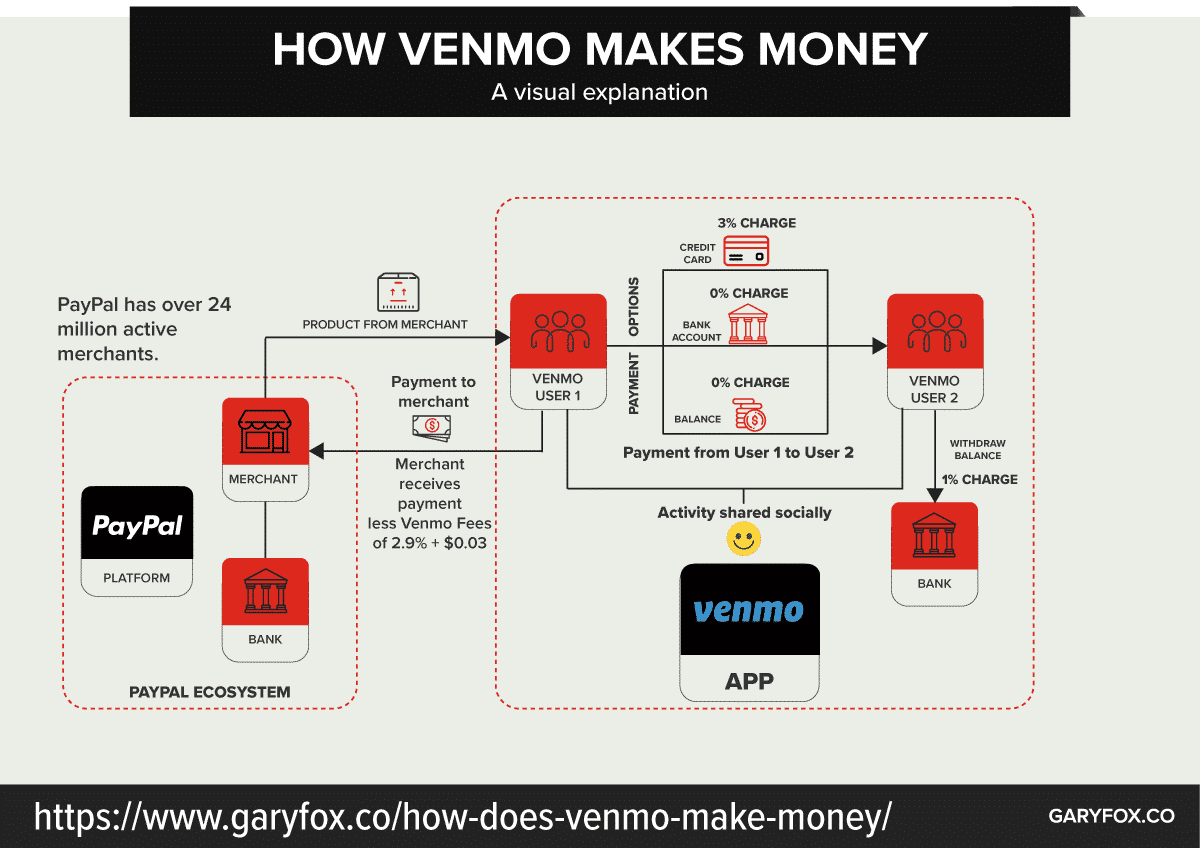

All investing involves risk, including loss of principal. Instantly transfering money to your linked debit card or bank account (a 1.75 percent fee) With Venmo for business, your primary fee is the nonrefundable seller transaction fee, which is 1.9 percent plus 10 cents of every payment you receive that’s 1 or more. This is not an offer to buy or sell any security or interest. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. SmartAsset does not review the ongoing performance of any RIA/IAR, participate in the management of any user’s account by an RIA/IAR or provide advice regarding specific investments. For personal accounts on PayPal and consumer and business profiles on Venmo, users will pay 1.75 of the transfer amount, with a minimum fee of 0.25 and a maximum fee of 25. The 1.5 fee is on par with other payments apps like Cash App. Venmo charges a 1.5 fee from the transfer amount for each transfer, with a minimum fee of 0.25 and a maximum fee of 15. SmartAsset’s services are limited to referring users to third party registered investment advisers and/or investment adviser representatives (“RIA/IARs”) that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. The new instant transfer fee will be 1.5, with a minimum fee of 0.25 and a maximum fee of 15. Securities and Exchange Commission as an investment adviser. Sending money to people using your credit card. Sending money to people using the Venmo account balance, debit card or bank account. No hidden fees It costs nothing to send or receive money using what’s in your Venmo account or bank account. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. There are many ways to send and receive money into your Venmo account and they come with different fees.

0 kommentar(er)

0 kommentar(er)